Every four years or so, a seismic event quietly takes place in the world of Bitcoin—an event that has historically signaled the beginning of a crypto bull market (see glossary). It doesn’t involve a major hack, a new coin launch, or a celebrity endorsement. Instead, it’s coded into Bitcoin’s DNA—Bitcoin Halving.

Understanding Bitcoin halving cycles isn’t just a matter of curiosity for techies and traders; it’s crucial for anyone trying to forecast where the crypto market is headed.

This post takes you on a deep historical and technical dive into what Bitcoin halving is, how it works, and—most importantly—why it often triggers bull markets.

Let’s decode the phenomenon and arm you with insights that could shape your next crypto investment move.

What is Bitcoin Halving?

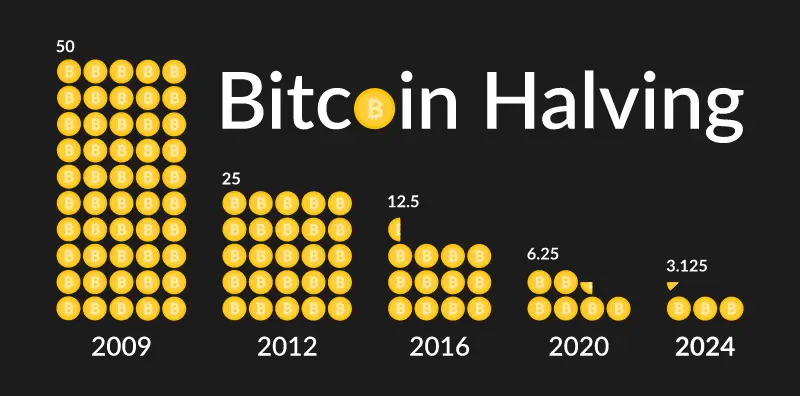

Bitcoin halving is a programmed event that reduces the reward miners receive for validating transactions by 50%. This occurs roughly every 210,000 blocks, which translates to approximately once every four years. The process is a built-in monetary policy designed to control Bitcoin’s inflation.

When Bitcoin launched in 2009, miners received 50 BTC for each block. That reward dropped to 25 BTC in 2012, then 12.5 BTC in 2016, and 6.25 BTC in 2020. The next halving, projected for 2024, will bring the reward down to 3.125 BTC.

The halving will continue until all 21 million Bitcoins are mined—expected around the year 2140.

What Happens During Bitcoin Halving Cycles?

The Bitcoin halving cycles theory is an entire ecosystem—from miners to traders to long-term holders. Here’s what typically unfolds during and after a halving event:

Mining Becomes Less Profitable

When the block reward halves, miners earn 50% less Bitcoin for the same amount of computational work. For many small or inefficient mining operations, this can lead to negative profit margins, especially if Bitcoin’s price doesn’t increase quickly enough to offset the loss.

As a result, only miners with low electricity costs and cutting-edge hardware tend to survive post-halving. This often leads to:

- Temporary hash rate dips

- Mining centralization risks

- Pressure to increase operational efficiency

Reduced Bitcoin Supply

Bitcoin’s fixed supply cap of 21 million makes it a deflationary asset by design. Halving slows down the rate at which new BTC enters circulation, reducing supply at a time when demand might remain constant or even rise.

This basic principle of supply and demand is one of the primary reasons halving events have historically led to price surges.

Increased Media and Retail Interest

Bitcoin halving tends to generate a lot of buzz. It’s often featured in mainstream financial outlets, crypto forums, and social media channels. This spike in attention typically brings new retail investors into the market.

This wave of new demand during a period of decreasing supply acts as a catalyst for price increases—potentially triggering the early stages of a bull market.

Why is Bitcoin Halving Cycle Chart Important?

From the above Bitcoin halving cycles chart, it is obvious that it isn’t just a technical event—it’s a major milestone that reinforces Bitcoin’s monetary structure and long-term value proposition.

Reinforces Scarcity and Store of Value Narrative

Halving is a crucial component of Bitcoin’s deflationary nature. By reducing the pace of new supply, it ensures that Bitcoin remains scarce. Scarcity is a foundational pillar of any store of value asset, including gold.

Investors increasingly view Bitcoin as “digital gold,” and halvings make this comparison even more potent.

Institutional Confidence Booster

Each halving acts like a stress test for the Bitcoin network. The ability to cut miner rewards without disrupting the blockchain’s core functions demonstrates the resilience and predictability of the protocol.

This predictability builds confidence—especially for institutional investors who demand transparency and rule-based systems. As institutions observe multiple successful halvings, their trust in Bitcoin as a long-term asset strengthens.

Signals Maturity and Network Stability

Bitcoin halving also illustrates how economically self-adjusting the network is. It forces miners to evolve, discard outdated hardware, and increase efficiency.

Each halving essentially “cleanses” the mining landscape, making the network more robust.

It’s also a milestone that signals technological maturity and economic evolution to stakeholders.

The Effects (Implications) of Bitcoin Halving Cycles Theory

The consequences of a halving ripple through the crypto economy in multifaceted.

Historical Price Surges

Historically, Bitcoin has entered a bull market phase within 6–18 months following a halving. For example:

- 2012 Halving: Bitcoin rose from ~$12 to over $1,100 within a year.

- 2016 Halving: Price jumped from ~$650 to nearly $20,000 by the end of 2017.

- 2020 Halving: BTC surged from ~$8,000 to an all-time high of ~$69,000 in 2021.

On July 14, 2025, Bitcoin reached an all-time price of $122,838!

While past performance isn’t a guarantee of future results, the pattern is undeniably compelling.

Altcoin Market Reactions

Bitcoin dominance tends to rise during the early stages of a post-halving rally. But eventually, the altcoin market catches up. This is partly due to investors rotating profits from Bitcoin into other promising crypto assets.

Halvings, therefore, don’t just impact BTC—they set the tone for the entire crypto cycle.

Volatility and Market Psychology

Volatility typically increases around the halving event due to speculative trading and heightened media coverage. Traders often “buy the rumor and sell the news,” causing unpredictable short-term swings.

Understanding these psychological dynamics is essential for making informed investment decisions.

Bitcoin Halving FAQs

Q: When is the next Bitcoin halving expected?

A: The next halving is projected to occur around April 2024, when the block reward will decrease to 3.125 BTC.

Q: Is Bitcoin halving guaranteed to cause a price increase?

A: While historical patterns suggest a correlation between halving and bull markets, market conditions also play a role. It’s not guaranteed, but the reduced supply often supports upward momentum.

Q: How many Bitcoin halvings will there be?

A: There will be 32 halving events until all 21 million Bitcoins are mined. The final halving is expected to occur around the year 2140.

Q: Does halving affect Bitcoin transaction fees?

A: Not directly. However, as block rewards shrink, miners will increasingly rely on transaction fees for income. This could impact fee structures in the long term.

Why Bitcoin Halving Cycles Could Trigger Bull Markets

Bitcoin halving is more than just a code-based reduction in mining rewards—it’s an economic lever that influences supply, sentiment, and pricing.

Over the last decade, each halving has played a role in initiating bull markets, reducing supply while increasing media attention and investor demand.

As we look ahead to future halving events, understanding this mechanism becomes vital for any serious crypto participant.

Here’s what we’ve covered so far:

- What Bitcoin halving is and how it works

- What happens during and immediately after a halving event

- Why Bitcoin halving matters from a scarcity and institutional confidence standpoint

- Historical and market-wide implications of Bitcoin halving events

Ready to prepare for the next Bitcoin halving cycle?

Join our newsletter to stay informed with in-depth analysis, forecasts, and market insights tailored for U.S. crypto investors.